Protect Your Furry Buddy With Comprehensive Pet Dog Insurance Coverage

In a period where family pet possession is progressively linked with our economic and psychological dedications, the importance of extensive animal insurance can not be overemphasized. Insurance. Comprehending these facets is essential, specifically when considering what alternatives best suit your pet's distinct needs and circumstances.

Recognizing Pet Dog Insurance Policy

Comprehending animal insurance is crucial for pet dog owners seeking to take care of the economic dangers connected with vet care. Animal insurance policy functions as a safety and security internet, aiding to balance out the commonly unforeseeable and potentially high expenses of medical treatments for pets. By paying a month-to-month premium, animal proprietors get access to coverage for a range of vet costs, which can consist of routine exams, emergency treatments, drugs, and surgeries.

Additionally, it is vital to assess the waiting durations, which are the timeframes before protection begins, in addition to any type of breed-specific conditions that may influence qualification. Insurance. Comprehending these components can empower pet proprietors to make educated decisions, making sure that they choose a plan that straightens with their family pet's special health needs and their very own monetary abilities. By grasping the principles of family pet insurance coverage, owners can much better get ready for unforeseen vet costs

Advantages of Comprehensive Protection

Comprehensive animal insurance policy protection offers a durable service for pet proprietors seeking comfort regarding their pet dog's healthcare demands. This type of insurance usually includes a wide selection of services, consisting of routine vet check-ups, inoculations, emergency treatment, surgeries, and also specialized therapies.

One of the key benefits of detailed coverage is economic defense versus unforeseen vet costs. Veterinary costs can build up quickly, especially in emergencies or for persistent conditions. Detailed plans ease the financial concern, permitting pet owners to make wellness choices based on their animal's requirements instead than their budget.

Additionally, detailed insurance coverage frequently consists of preventative treatment, advertising regular health examinations and inoculations. This aggressive strategy helps spot prospective health and wellness problems early, leading to far better end results and possibly reduced lasting prices.

Furthermore, many extensive plans provide versatility in selecting vet service providers, ensuring that family pet proprietors can look for care from trusted professionals without restrictions. This flexibility improves the overall top quality of treatment that family pets receive.

Types of Pet Dog Insurance Program

Pet insurance plans come in various types, each made to satisfy the diverse requirements of pet proprietors. One of the most common kinds consist of accident-only plans, which cover injuries resulting from crashes but do not consist of ailment or preventive treatment. These strategies are often more inexpensive, making them ideal for those trying to find fundamental protection.

Detailed or wellness plans use a broader variety of solutions, including both crashes and health problems, along with precautionary care like vaccinations and routine veterinary brows through. This sort of strategy is advantageous for animal proprietors seeking extensive protection for their fuzzy companions.

Another alternative is the breed-specific plan, customized to address health and wellness concerns prevalent in certain types. These strategies can supply comfort for owners of breeds home understood to experience hereditary conditions.

Exactly How to Select the Right Policy

Exactly how can you identify which pet insurance plan best fits your demands? Begin by examining your pet's certain wellness needs and any type of pre-existing conditions (Insurance). Understanding your pet's age, breed, and way of living can likewise lead you in selecting a plan that supplies ample protection

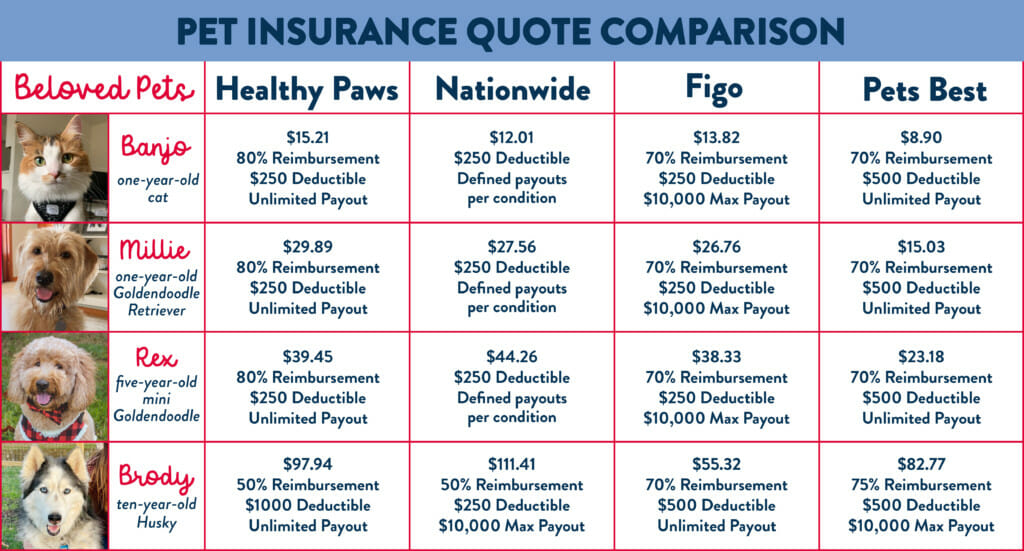

Next, contrast the various kinds of insurance coverage available, including accident-only plans, comprehensive strategies, and health add-ons. Extensive plans normally cover accidents, ailments, and often preventative treatment, while accident-only strategies might be extra economical but limited in range.

Think about the plan's protection restrictions, deductibles, and compensation percents. A reduced premium might appear attractive, however make certain that it does not come at the expense of higher out-of-pocket prices when you require care.

Additionally, research the insurance firm's online reputation and consumer service evaluations. A business understood for punctual claims handling and outstanding client support can make a significant difference throughout stressful situations.

Usual Misconceptions Concerning Family Pet Insurance Coverage

Numerous pet proprietors hold false impressions regarding animal insurance policy that can prevent their decision-making process. One prevalent idea is that all pet dog insurance coverage plans are the exact same.

If the animal is healthy and balanced,One more usual false impression is that pet insurance coverage is unneeded. However, crashes and illnesses can occur all of a sudden, causing costly veterinary expenses. Early enrollment in a policy can offer satisfaction and financial security against unanticipated occasions.

Lastly, some proprietors believe discover this they will certainly not make use of the insurance coverage sufficient to validate the cost. Yet, the unforeseeable nature of animal wellness makes insurance a beneficial financial investment for any kind of liable pet dog proprietor. Recognizing these misconceptions can encourage pet dog owners to make informed decisions regarding their furry buddies' healthcare.

Verdict

In final thought, comprehensive animal insurance policy serves as a vital safeguard for the wellness and health of family pets. Resolving usual misunderstandings about family pet insurance additionally boosts understanding of its importance, ultimately contributing to the joy and wellness of beloved fuzzy buddies.

Comprehending pet dog insurance policy is important for pet dog proprietors seeking to manage the monetary threats associated with veterinary care.Family pet insurance prepares come in numerous types, each designed to satisfy the varied demands of pet dog proprietors.Several pet owners hold false impressions about family pet insurance policy that can impede their decision-making procedure. The unpredictable nature of pet wellness makes insurance policy a valuable investment for any accountable animal proprietor.In final thought, comprehensive pet dog insurance serves as an important safeguard for the health and wellness of family pets.